Get Your Financial $hit Together

An 8-Week Online Course that will help you lower your bills, save some extra money, invest for your future, and have cash on hand to do the things you love.

Have you ever wondered…

- Where does all my money go?

- Why don’t I have more discipline?

- When am I going to stop feeling broke?

- Why can I never seem to get ahead?

- Will I ever be able to retire?

- You know you earn “enough” but all the little expenses add up and you can’t seem to get ahead.

You wish you had more saved so you’d feel less nervous about those impending car repairs, medical bills, and birthday gifts for friends.

You know you should be invested in the stock market but you just don’t know where to start, and you’re kicking yourself for not knowing how.

You are constantly second-guessing whether you should pay down debt or save your money.

In just 8 weeks, you’ll finally feel the relief and excitement that comes with having a plan for your money.

What will this course do for you?

- Ease your money worries.

- Take the guesswork out, so you’re not wondering where to start.

- Reduce your feelings of shame, intimidation, and anxiety; and increase your confidence.

- Make money EASY to understand, fun to learn about, and simple to do!

- Give you a support system. You’ll finally have a safe space to go for help and to ask all of your questions.

“With your mindset-changing course… we were able to pay off 100% of our credit card debt. Our savings is now around $2,000 per month!”

I’m a 33-year-old married physician and dog mom. This course gave me the kick-in-the-butt to actually implement some of the strategies I’ve been thinking about for years. My win during this course was opening an investment account and making trades… it’s been so fun!”

Hi, I’m Rachel! I am a lot of things…

- Former financial advisor

- Bestselling author of two books on financial literacy

- Real estate investor; built rental portfolio of almost 40 units by age 26

- 27-year-old retiree (now 30)

- Entrepreneur with $20,000+ per month in passive income

I’m on a mission to empower women, young professionals, and millennials to take control of their financial future. Anyone, at any age, on any income, can achieve financial independence.

This course is for you if:

- You’re tired of feeling panicked and stressed when it comes to personal finance.

- You’re fed up with your financial situation, and ready to change.

- You know what to do, but you just haven’t done it.

- You need help with discipline and accountability.

- You don’t know where to begin. You’re overwhelmed and you just need help.

- You are living paycheck-to-paycheck and ready to learn how to get ahead.

- You have student loan bills and other debt payments that are holding you back.

- You want to increase how much money you save but you feel stuck.

- You know you should be invested in the stock market but you’re intimidated.

Why now? Why should you care?

Time is your biggest advantage. The earlier you can act on these sound principles, the better off you will be when you retire. Getting your financial $hit together right now – this very day – instead of putting it off for weeks, months, years, could mean the difference between retiring in poverty or in wealth. Every moment you delay is a moment where your money is not working for you. Although your financial future feels far away, you must not underestimate the urgency of taking action now. You cannot afford to wait.

Past course takers saved an average of $2,042.71 because of and during this course!

Listen to what Karina and Karolyn think:

Get Your Financial $hit Together is fun, engaging, and taught through a series of short videos over the course of 8 weeks. The course is designed to complement my bestselling book, Money Honey.

Here’s what you get:

- 50+ short and simple videos

- Access to an exclusive online community for course takers

- Regular check-ins for accountability

- Weekly challenges that will boost your savings rate

- Personalization: everything you learn can be personalized for your specific circumstances and needs

- A free digital download of Money Honey

Take a look at the curriculum!

Week 1: Intro & Tracking Expenses

- Deep-dive into money goals

- Reflective journaling questions & your WHY

- Overview: best budgeting apps

- Access Rachel’s expense tracker and learn how to use it

- Estimate your Golden Number, a concept from Money Honey

- What if I don’t make a consistent income?

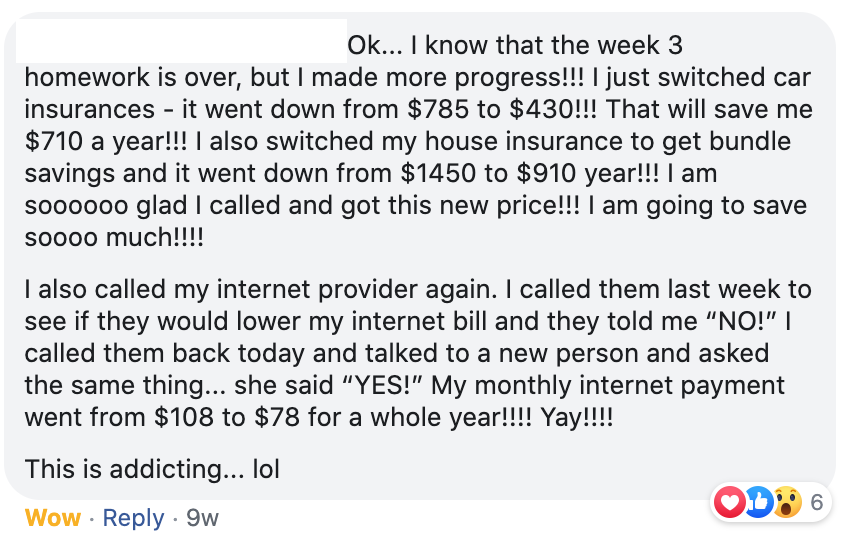

Week 2: Cutting costs (without being unrealistically restrictive)

- How to negotiate bills and fees, with scripts

- The $100 Rule and the Big 3

- What if I live in a high-cost-of-living area?

- Brainstorming ways to cut costs

Week 3: Increasing income (the non-MLM way)

- What is income diversification and why should I be doing it?

- How and when to ask for a raise

- 6 apps for making money without leaving your house

- Access to the Master Idea List (62 ways to increase your income)

Week 4: Net Worth & Savings Buckets

- Budget & Golden Number review

- See Rachel’s net worth worksheet

- $1,000 emergency savings bucket strategy

- Bucket #2, #3, and #4 strategy

Week 5: Debt and the GYFST Strategy

- How debt-averse are you?

- Snowball method vs. Avalanche method and which is better

- Should I consolidate my debt?

- Access the GYFST Template and customize your strategy

Week 6: Credit Strategies that will save your financial life

- What is your credit card personality?

- Analyzing your credit factors & taking steps to improve

- How to find errors on your credit report and dispute them

- Credit card balance transfers: are they a good idea?

- Protect yourself from phishing and identity theft

Week 7: Why you must start investing NOW

- Penny example to show the power of time and compounding

- 2 hypothetical investing case studies

- How to make a trade in the stock market

- See Rachel’s personal portfolio and investments

- Which accounts to use to get started

Week 8: Wrap Up

- Putting it all together… what is your overall strategy moving forward?

- Money mindset and affirmations

- Potential obstacles & barriers to watch out for

- What to do when you fall off the wagon

- Tips to ensure long-term success

Plus Bonus Content! (it’s a surprise)

FAQ

You might be wondering…

-

How long will it take me to go through the course?

If you stick to the suggested weekly pace, you’ll spend 2-3 hours per week learning and completing the assignments… only 26 minutes per day!

-

Why do I need this course if I can just read Money Honey?

First, some people are great at holding themselves accountable and can easily read and implement things right away. The vast majority of people, however, struggle with self-discipline. Structure, group support, and public accountability will increase your odds of “getting your financial $hit together” tenfold. Taking this course will help you actually do the things you should be doing.

Second, this course dives much deeper into topics that are only touched on in the book. You will also get additional tools and resources, such as scripts, templates, and the entire Excel digital workbook.

-

What exactly will I be learning?

This course is designed to go along with the book Money Honey. Topics include budgeting, saving, debt payoff, and investing. The focus is on implementation so that you can do the things you know you should be doing.

-

What is the refund policy?

Please read the full Terms and Conditions here.

-

Will I ever lose access?

Nope! Once you purchase, you’ll never lose access to the course materials, online group, and videos.

-

Can dudes or non-US residents take the course?

This course is open to anyone that wants to sign up! Information and financial advice will be geared towards US residents.

-

Do you guarantee results?

The testimonials and examples used are not intended to represent or guarantee that anyone will achieve the same or similar results. Each individual’s success depends on many factors, including his or her background, dedication, desire, and motivation.